Board of Directors

- TCC has a one-tier board system

- The TCC 25th Board of Directors composed of 15 Directors, including 5 Independent Directors and 4 female Directors, representing 26.66% of the Board's seats

- According to the sustainable development strategy, the selection is made up of experts with rich professional skills and industry experience in cement, accounting, law, finance, international markets, AI applications, and IT

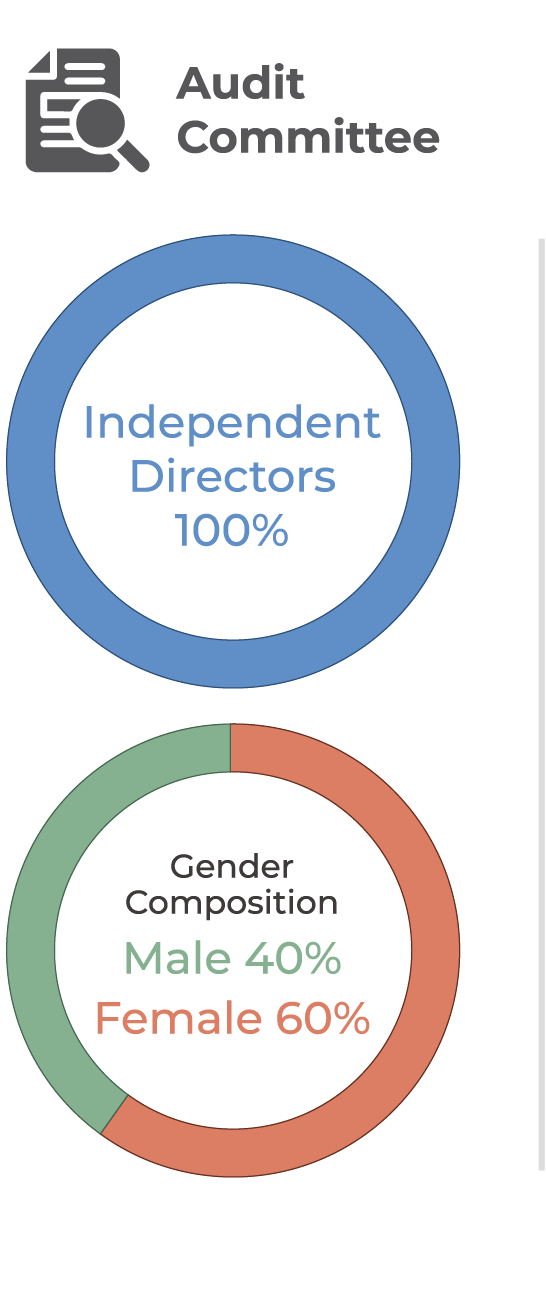

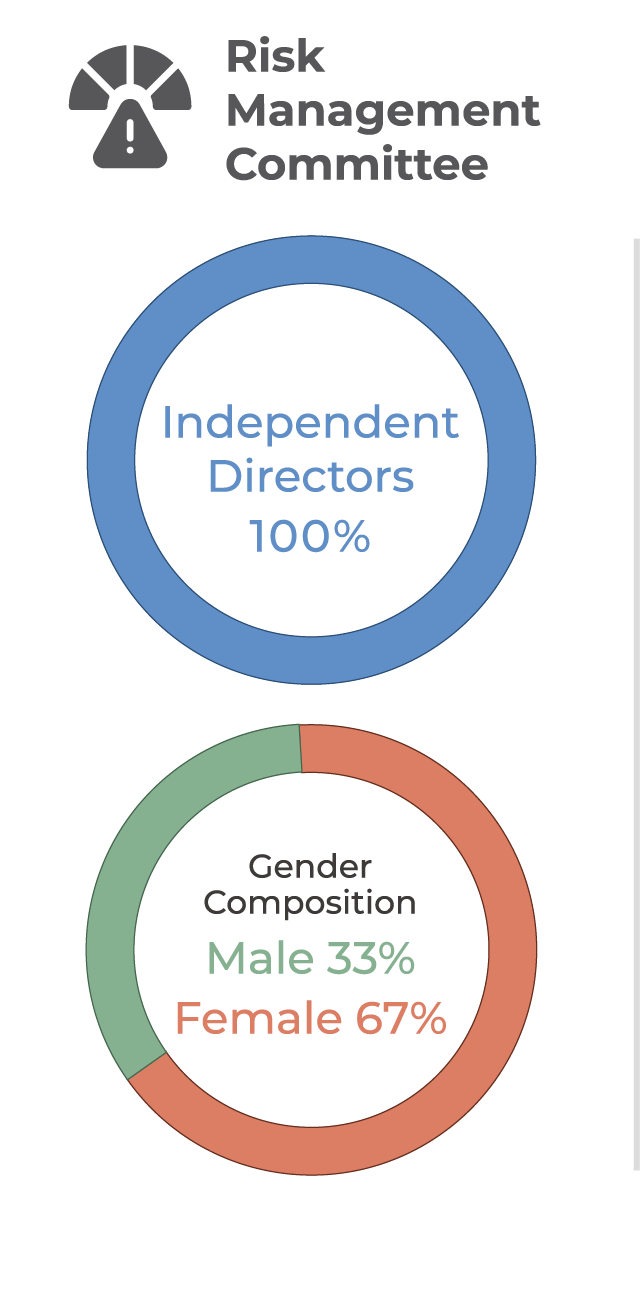

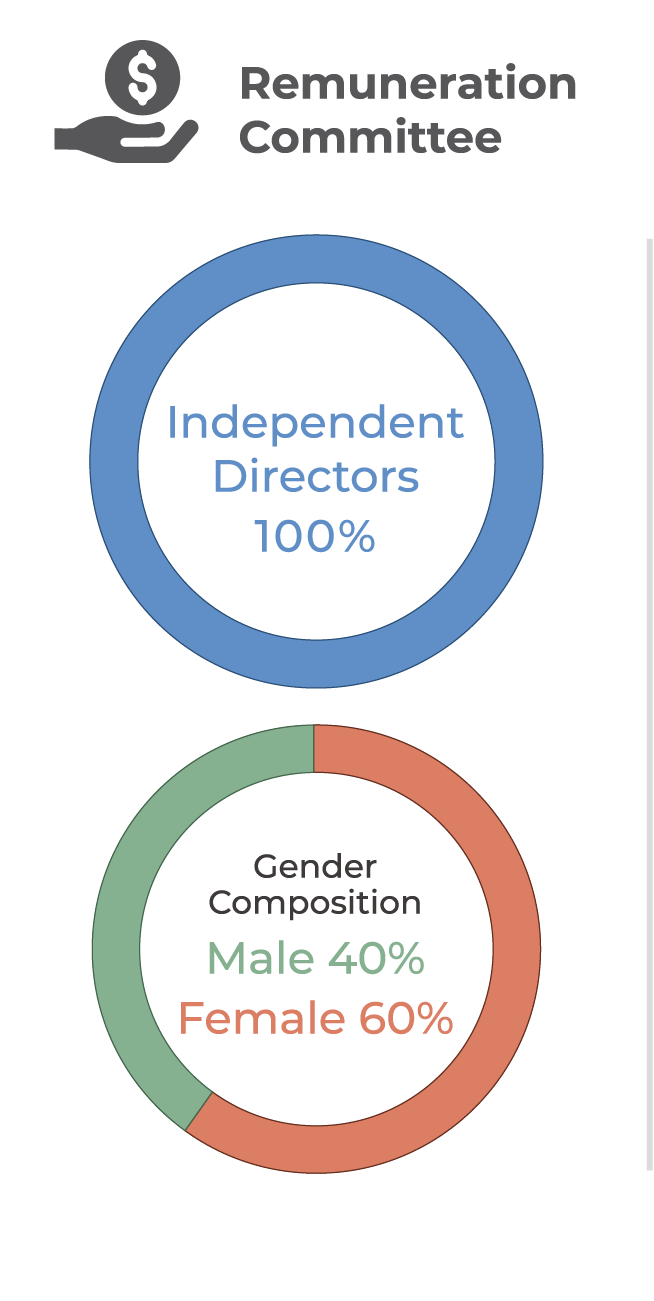

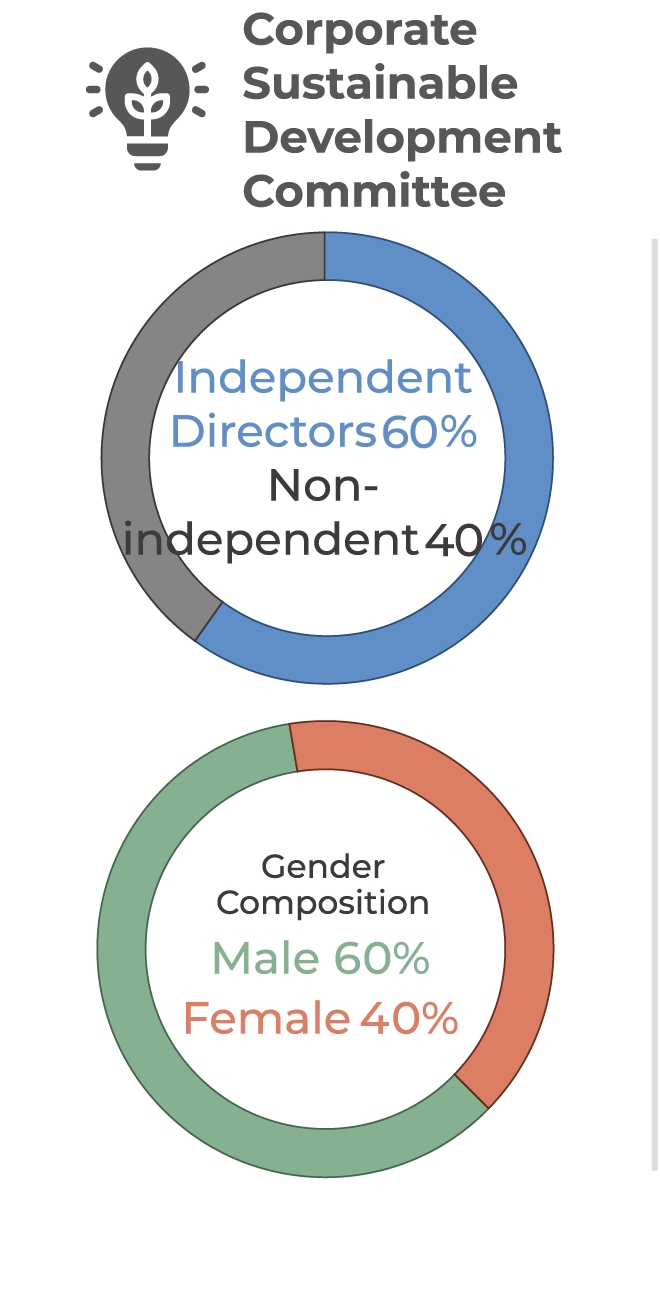

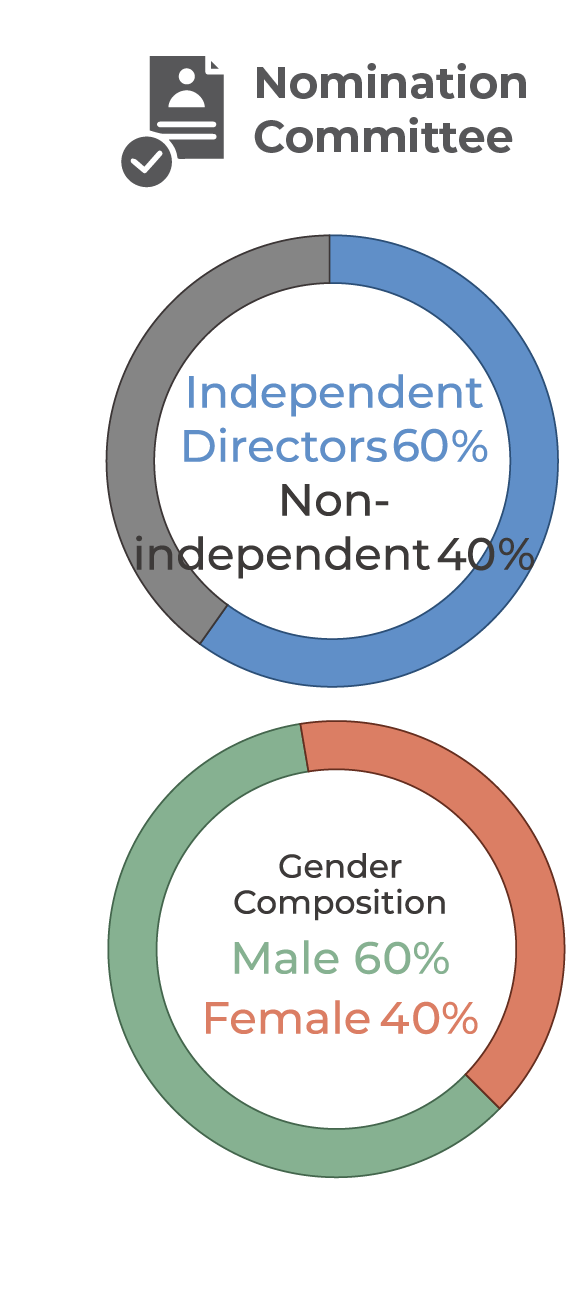

- 5 Functional Committee: Nomination Committee, Remuneration Committee, Audit Committee, Risk Management Committee, Corporate Sustainable Development Committee

- TCC Board of Directors has set up many functional committees to strengthen and enhance the monitoring and management functions

- The total training hours for the Directors and Independent Directors in 2023 reached 111.5 hours. . (including ESG courses)

Ethical Management

Policy

- TCC prioritizes professional ethics, and has stipulated “Ethical Corporate Management Best Practice Principles”, “Code of Ethical Conduct”, and “Anti-Corruption and Anti-Bribery Policy”

- Zero Tolerance for Corruption and Bribery

- Board of directors, managers, employees, mandataries, and substantial controllers shall not use non-public information he/she knows to conduct insider trading/dealing and/or money-laundering

Management Approaches

- "Anti-Corruption and Anti-Bribery Working Group" is established, with the President serving as the highest management level of the management system.

- Annual corruption and bribery risk assessments are conducted for employees and business partners.

- Incorporate integrity management indicators such as anti-corruption, bribery, and legal compliance into employee performance evaluations.

- The “Related Party Transaction Procedure Management Directions” were enacted to strengthen the supervision of related party transactions.

- Updated “Business Partner Corruption Risk Assessment and Due Diligence Procedures” in 2023 to include countermeasures for non-compliant suppliers, contractors, and customers.

- In response to emerging legal compliance issues, such as anti-money laundering, anti-corruption, and environmental health and safety, these are incorporated into standard contracts, becoming the norms for business partnerships and commercial cooperation with TCC.

- Policies related to ethical management are always available on TCC official website and internal portal, allowing for access to ample information at any time.

Performance

- TCC is the first enterprise in Taiwan to obtain the "ISO 37001 Anti-Bribery Management System" certification. Among the Operation Headquarters as well as the Taipei Plant, Taichung Plant, Kaohsiung Plant, Hoping Plant, and Suao Plant thereunder, the Operation Headquarters was the first to be certified. After receiving the certification in August 2021, the renewal was completed in July 2023.

- 0 incident of corruption reported

- 100% Employee signing rate of “Statement of Integrity and Ethical Conduct”

- 100% Mid-or high risk personnel signing rate of “Integrity Code”

Education & Training

- TCC Code of Ethics values and standards is reinforced through training courses on a yearly bases, via face-to-face courses, online courses (TCC Lyceum) and documents, covered issues such as fraud, verbal harassment, sexual harassment, conflicts of interest, and the protection of confidential information.

- In 2023, total hours for integrity and ethics training amounted to 3,904.2 hours, with a total of 17,592 participants, achieving a 100% completion rate at the General Administration Division.

- An ISO 37001 promotion team has been established, with a 100% participation rate among members of the additional special education and training.

- Ethical management-related education and training participants include directors, suppliers, contractors, employees, new recruits, and interns.

- Education and training are gradually extended to contractors, with a cumulative total of 22 individuals in Q1 2024, and training hours amounting to 18.7 hours.

- In terms of anti-competition and anti-monopoly, for employees who are in close contact with customers, the definition and constitutive requirements of concerted actions in legal terms are introduced, with a completion rate of 100%.

New recruits

(part-time and casual employees included)

are required to sign on “Code of Integrity and Ethics Statement” while starting work; within 90 days thereafter the one-on-one elaboration on Company’s anti-corruption and anti-bribery policies shall be completed with records to ensure his/her clear understanding of the regulations and avoid any misconduct. A 100% signing rate of all new recruits was achieved in 2021 and 2023

Active employees

(part-time and casual employees included)

Each employee must attend annual anti-corruption and anti-bribery training programs and maintain attendance records. It is important to have a comprehensive understanding of operational standards and the potential risks of non-compliance. In 2023, a total of 799 hours of anti-corruption training were conducted. Furthermore, for colleagues responsible for assessing potential corruption in customer and supplier transactions, as well as departmental operational processes, thematic educational training was conducted. The cumulative training hours in 2023 have reached 2744.3 hours.

Directors

receive the Company’s anti-corruption and anti-bribery education and training course materials via mail or hardcopy at least once a year and are required to sign on the “Letter of Commitment for Compliance with Ethical Management, Anti-corruption, and Anti-Bribery”. ALL Directors have received relevant education and trainings and signed on the Letter of Commitment in 2021 and 2023

Suppliers

are communicated regarding the spirit of ethical management by means of mail, Suppliers Convention, etc., and all suppliers are required to sign on the Supplier Code of Conduct, in which items related to ethical management are included

Contractors

trainings are conducted while entering TCC’s sites; courses are completed in June 2022, and the trainings for outsourcers (e.g., the security guards) are also completed in June 2022

Anti-trust/Anti-competitive practices

Protecting reasonable business competition orders is a crucial commitment to Ethical Corporate Management. Taiwan Cement Company has always prohibited from the employees destroying free market mechanism by the violation of Fair Trade Act such as monopoly or share allocation

- Dedicated unit: The employees’ abidance and protocols towards competition laws are supervised by the Legal Office

- Protocols:

- If there are employees under investigation by the competent authority concerning competition law abidance, the following people should be notified immediately: manager and head of the department, and the Legal Office

- The Legal Office should understand the situation and corresponding competition laws. If there are risks of violations, the Legal Office should report to the management, seek assistance from external lawyer, and take responsive actions as soon as possible

- If the supplier violate or to be suspected to violate competition laws, relevant units should report to the Legal Office, and require the supplier to stop illegal conduct and coordinate with the competent authority’s investigation

- Regulations: The employees should abide by Ethical Corporate Management Best Practice Principles and Fair Trade and Antitrust Compliance Guidelines , to protect fair trade and decrease the Company’s possible legal risks and negative effects caused by the illegal conducts

- Trainings: Managers and business-related employees should receive fair trade training regularly

- Discussions about sensitive information should be avoided in daily work, such as price, amount, capacity, counterparty, market share distribution, etc.; and attendance of social occasions involving the mentioned information should also be refused. Meanwhile, stay alert when fellow workers mentioning about such information

Reporting System & Whistleblower Protection

- TCC has established a "Reporting Mechanism for Violation of Code of Conduct," which not only clearly defines the procedures and channels for reporting but also outlines the applicable scope, including: corruption, theft, embezzlement, self-dealing, fraud, improper provision or receipt of benefits from others, and other corrupt and bribery actions, actions that violate the company's established systems, regulations, and methods, as well as actions that violate laws and regulatory orders.

- Whistleblowers may choose to report either anonymously or with their identity disclosed. If reporting anonymously, complete relevant information and documents must be provided. The identity of the whistleblower and the content of the report will be kept confidential and access will be restricted. It is promised to protect whistleblowers from improper treatment due to their reporting.

-

TCC official website and internal portal both have an employee suggestion inbox: TCCsuggestion@taiwancement.com

Employee Grievance Mailbox: TCCsuggestion@taiwancement.comReporting Mailbox: mp.buster@taiwancement.comReporting mailbox for matters involving ethical issues of senior management: tccwhistle@taiwancement.com

- Cases Reported

| Whistleblower Inbox |

Audit Committee Inbox |

Employee Grievances Inbox |

Cases Reported Regarding Violations of Ethical Management Policies |

Cases involving discrimination or harassment | |

|---|---|---|---|---|---|

| 2019 | 0 | 1 | 7 | 2 | N/A |

| 2020 | 10 | 1 | 12 | 13 | N/A |

| 2021 | 4 | 7 | 12 | 7 | N/A |

| 2022 | 9 | 6 | 15 | 12 | 1 |

| 2023 | 16 | 4 | 15 | 13 | 0 |

Risk Management Policy

-

Policy

In response to changes in the company's development strategy, TCC board of directors approved the revision of the “Risk Management Policy ” on May 14, 2024, incorporating "biodiversity" as one of the risk identification categories to prevent and reduce the impact of operational activities on nature and biodiversity.

-

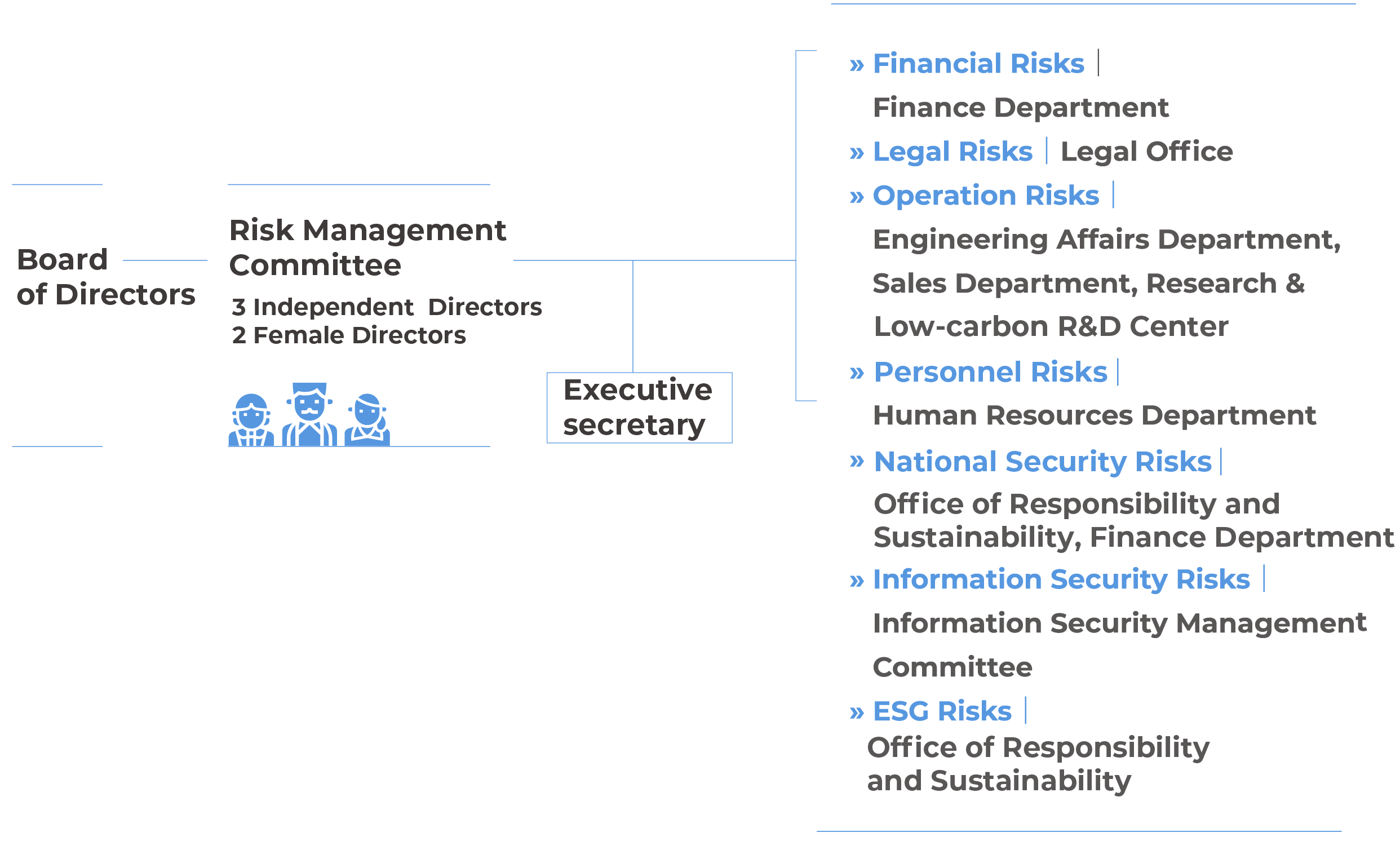

Organizational Structure

In May 2020, a Risk Management Committee directly under the Board of Directors was established. It was re-elected in 2021 with the addition of members with legal backgrounds. It is now composed of 3 members, all of whom are independent directors with risk management backgrounds, including 2 females.

-

Procedure

TCC refers to the World Economic Forum (WEF) 2023-2024 Global Risk Report, cement and energy industry risk reports, and international trends, conducting risk identification based on 7 major aspects. The risk criteria are incorporated into the development of products and services. The results of risk identification are then addressed through strategic planning by various departments. At least once a year, the Risk Management Committee presents a risk management report to the Board of Directors.

-

Operation

1. 2 meetings held in 2021 (August 12 and November 8), both with 100% attendance of committee membersReport updates of the Company’s risk matrix, TCFD execution progress, implementation of ISO 37001 Anti-Bribery management system2. The 3rd meeting held in 2022 (August 5)Report updates of the Company’s risk matrix, which was updated based on the factors such as war, geopolitics, energy transition, and demographic structure. The impact and mitigating actions are also reported3. The 4th and 5th meeting held in 2023 (3/24、11/10)Report on the update of risk matrix, climate-related performance indicators and targets, and the potential impact of Taiwan's carbon fee collection in the 2024 and payment in 20254. "Risk Management Policy and Principles" is included in TCC‘s annual mandatory training. All employees must read the policy documents and pass the tests. In 2023, 15,684 individuals completed training with 784.2 total training hours based on 5 minutes per document -

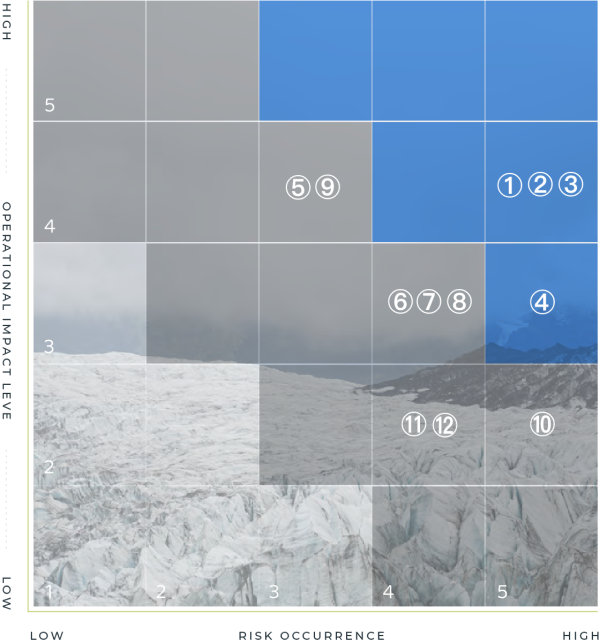

2024 Risks Matrix

- Risks in the development of the cement industry in Mainland China

- Exchange rate, interest rate, and fundraising risks

- Carbon fee / Carbon Tax / Carbon trading

- Natural disaster

- International Strategy

- IT security risks

- Warfare and geopolitical conflicts

- Compliance and litigation risk

- Talent recruitment and succession (including salary and incentives)

- Climate change risks – natural disaster (typhoon, flood, drought, wildfire)

- Supply and demand prices of raw materials (fuels) and substitutes

- Biodiversity

Company-specific Risk Exposure Description Mitigating Actions Risks in the development of the cement industry in Mainland China Due to real estate regulation in Mainland China and the gradual saturation of infrastructure, the demand for cement has declined - The China Cement Association has intensified staggered production efforts and implemented production cuts

- Monitoring the recovery of economic activities and market demand in various regions

- Paying close attention to local carbon reduction policies and accelerating carbon reduction to align with industrial policies

- Investing in low-carbon cement markets in Europe, Asia, and Africa to reduce reliance on the Mainland China market and stabilize cement business EBITDA

- Evaluating and adjusting some underperforming plants in Mainland China

Carbon fee / Carbon trading - Carbon trading, taxes, and fees to limit GHG emissions increase costs

- Emerging regulations on carbon trading, taxes, and fees will raise costs. If costs can‘t be passed through to prices, profits may decline

- Without CBAM or carbon costs on imports, business risks increase

To effectively mitigate the impact of carbon trading/carbon fees/carbon taxes, TCC has implemented several measures aimed at reducing greenhouse gas emissions:-

GHG Scope 1, 2 and 3:

1. Plan and set science-based carbon reduction targets aligned with the 1.5-degree pathway 2. Establish sustainability business coordination unit 3. Establish ESG Data Management System 4. Implement internal carbon pricing management and internal carbon trading mechanisms -

GHG Scope 1 and 2:

1. Implementing seven strategies (including: Alternative Raw Materials; Alternative Fuels; Equipment & Process Enhancements; Power Generation by Waste Heat Recovery; Renewable Energy Installation; Energy Storage, Power Cells, and Charging Services; Carbon Negative Technologies-Carbon Capture, and Carbon Sink) -

GHG Scope 1 and 3:

1. Introducing EV electric mining trucks and low-carbon vehicles 2. Initiate the collection and guidance of supplier carbon emission data

-

Climate Transitions and Emerging Risks*

Item Impact Mitigating Actions Climate Risks Carbon trading/carbon fee/carbon tax for Cap and Trade Increased operating costs, declining profits, and operational risks arise - Low-Carbon Circular Production

- Smart New Energy Business

Regulations and procurement of renewable energy Government penalty risk Costs in the low-carbon technologies, equipment and management Increased capital expenditures lead to disadvantages in market competition - Low-Carbon Circular Production

- Industry-Leading Low-Carbon Construction Materials

- Low-Carbon Supply Chain

Rising prices of raw materials and energy Create operational pressure Impacts to corporate reputation Lower the stakeholders' evaluation of the company - Low-Carbon Circular Production

- Industry-Leading Low-Carbon Construction Materials

- Low-Carbon and Carbon Negative Technology Innovation

- Smart New Energy Business

Impacts on the strength of supports from financial institutions in investment, financing, and insurance Affect investment willingness, generate operational risks Drought (Production) Rising operating costs impact operational activities - Climate Disaster Adaptation

Flood (Production) Business Interruption Risk Changes in precipitation patterns and extreme changes in climate patterns (Transportation) operational risks arise Transformation of the coal-fired Hoping Plant Increased operating costs, declining profits - Smart New Energy Business

Transition Risk – Breakthrough in the advanced technology of carbon capture and storage (CCS) Increased operating costs - Low-Carbon and Carbon Negative Technology Innovation

Emerging Risks Warfare and geopolitical conflicts The South China Sea's strategic importance means geopolitical conflicts there could disrupt Taiwan’s energy supply and TCC's access to energy resources. Additionally, these conflicts could hinder the import of 'low-alkali sand,' crucial for Taiwanese cement production, affecting the stable supply of this vital raw material. - Seek an alternative low-alkali sand source to reduce raw material supply disruption impacts.

- Plan alternative shipping routes to mitigate South China Sea conflicts' impact on transport.

Talent recruitment and succession (including salary and incentives) An imbalanced workforce supply-demand can disrupt corporate operations and make it challenging to recruit the necessary talent for future needs. As enterprises evolve, the demand for new skills increases, leading to higher personnel costs due to external talent recruitment and internal adjustments. - Develop operation sites worldwide and recruit talents internationally.

- Continuously improve pay structure to boost salary competitiveness.

- Conduct on-campus recruitment to proactively secure talent.

- Enhance talent retention through better development, benefits, incentives, and bonuses.

- Hire experienced personnel for knowledge transfer and succession planning.

Data Protection and Privacy

PolicyTCC Group aims to protect important information systems and the privacy, comprehensiveness and usability of data. The Information Security Management Committee was established following the ISO 27001 Information Security Management to set up data security standards and assessments. TCC Group Information Security Policy was stipulated in 2022. The administrative review and examination of the information security policy and relevant regulations in every December ensure an effective implementation of information security protection.

Management Approaches

ISO 27001 Information Security Management System obtained in January, 2021, and passed external recertification audits continually (2021/12 & 2023/01). Committed to the protection of the confidentiality, integrity, and availability of critical information system and data of TCC. The Committee is responsible for the promotion and review of the information security management system of TCC as well.

Organizational Structure

- TCC established the Information Security Management Committee in 2020. Within the Board of Directors, there is one director with information security experience, and one with AI experience.

- In 2022, a Chief Information Security Officer (CISO) was appointed and a dedicated information security team were instituted for the implementation and promotion of information security of the Group. The CISO serves as the committee chair and reports to the Board of Directors on a regular basis. The Committee convened 4 sessions in 2023.

- The Information Security Management Committee has been upgraded to a functional committee as of August 2024. The members include three independent directors: Victor Wang, Sherry S. L. Lin, and Ruu Tian Chang. Ruu Tian Chang previously served as the CIO of a publicly listed financial holding company

Information Security Objective

- Objective ZERO major data protection or privacy incidents

-

Results and Targets Linked with employees’ performance appraisal

Completed

Completed

HR/FIN/EMTConfidential data security zone established-Inventory of trademarks and patents-Expanded endpoint Information Security Review100% CompletedEducation and trainings 1,600 visit 1,800 hours - 4 sessions of awareness training-ISMS consultation for affiliatesERP recovery simulation completed (once per year) ERP data backed up to IDC (daily)EMT conducted 2023 4 timesSocial engineering drills 2023 6 timesCompleted third-party data security checks (twice per year)5 group-wise promotions-6 phishing incident notice-7 announcements to the energy businessPublic folder access restrictions-VPPN connection security settings-Two-factor authentication for sensitive area access-Private electronic device connection access control-Non-camera Smartphones

Sustainable Products & Services

-

Management Approaches

◤ TCC cares deeply about environmental balance and sustainable development. Therefore, the company has encouraged RMC clients to apply for green building certifications to promote the symbiosis of buildings and the environment to achieve a sustainable environment ◤ TCC assesses and manages risks associated with the inclusion of harmful chemicals in products, considering health and safety aspects from the product concept stage right through to product use. TCC conducts feasibility assessments for alternative raw and fuel materials, analyzing their components and performing harmful chemical analysis. Only after approval are these materials used. During the production process, in addition to ensuring production quality, we also monitor emissions. TCC‘s emissions are all below regulatory limits. We also conduct relevant product inspections to confirm the quality of the finished products. TCC has achieved the highest level of certification in circular economy by obtaining the BS 8001 certification for the use of alternative raw and fuel materials. 100% of TCC products possess Safety Data Sheets containing information on use, storage and application ◤ Monitoring customer feedback and work closely with academic institutions to continue to progress the safety standards of TCC products and services ◤ Continuously share product safety information with customers, safeguarding TCC's commitment to product safety -

Product Quality Management Mechanism

◤ Three-tier Quality Control System | 100% Products in Taiwan ◤ Quality Inspection Report or Product Conformity Certificate | 100% Products in Mainland China -

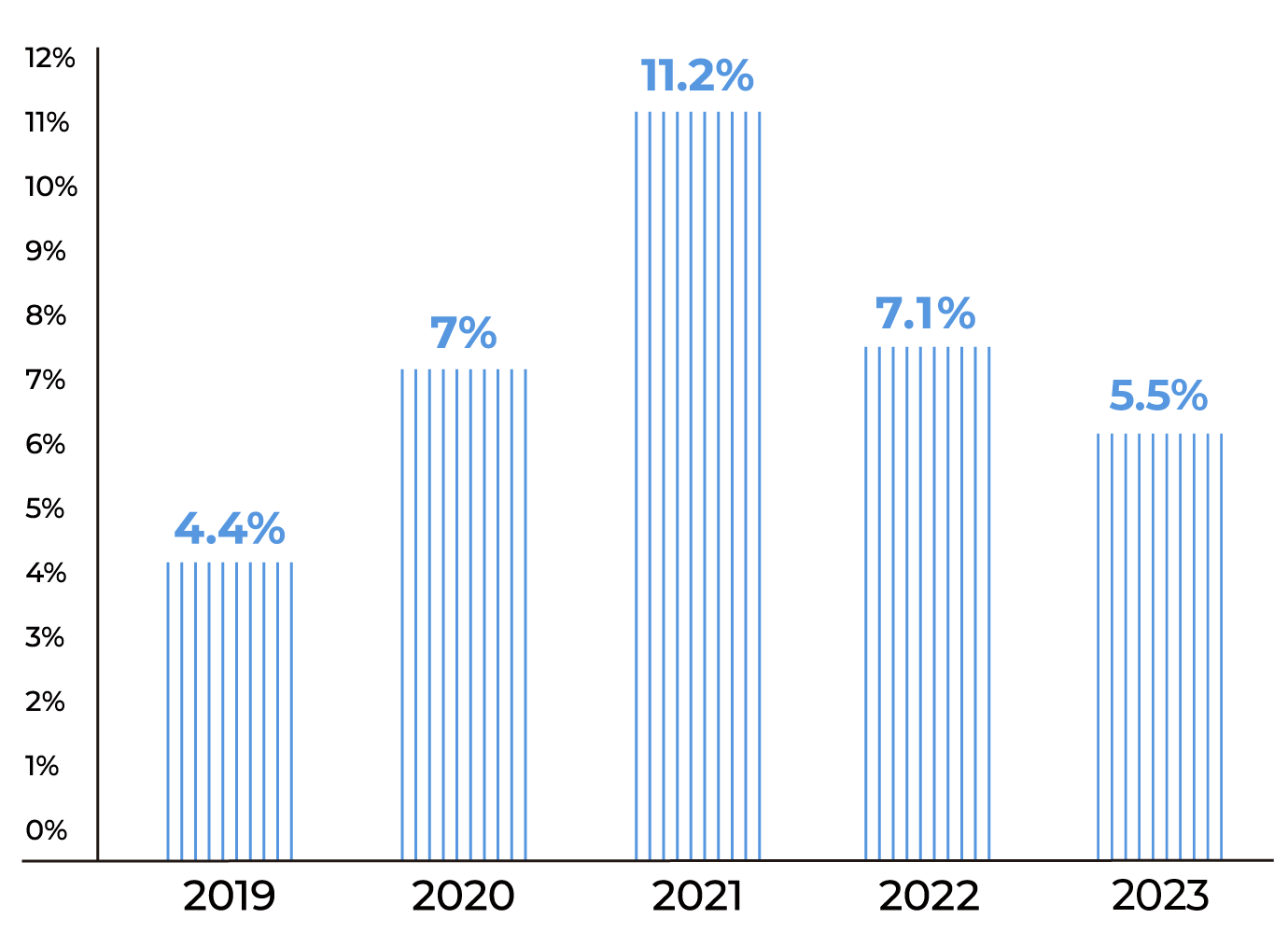

Targets

By 2025, TCC aims to achieve a revenue share of concrete used in green buildings that accounts for over 5% of the overall concrete revenue. By 2030, strive to surpass 6% revenue share.

-

Performance

◤ 100% implementation of the ISO 9001 Quality Management System ◤ Client Satisfaction 2020 2021 2022 2023 Taiwan market: Cement & Concrete 95.11 96.67 96.86 98.64 *Percentage of Clients Reporting Scores of Satisfied (Taiwan and Mainland China Weighted Average): 95.4%◤ Revenues from Sustainable Construction 2020 2021 2022 2023 Revenue share of concrete used in green buildings (Taiwan market) 7% 11.2% 7.1% 5.5%

Note: The percentage of green building applications returned to normal because the huge construction projects came to their ends and that some clients from the tech sector postponed the progresses of plants under construction in 2022

Total Solution: Comprehensive Low-carbon Circular and New Energy Building Solutions

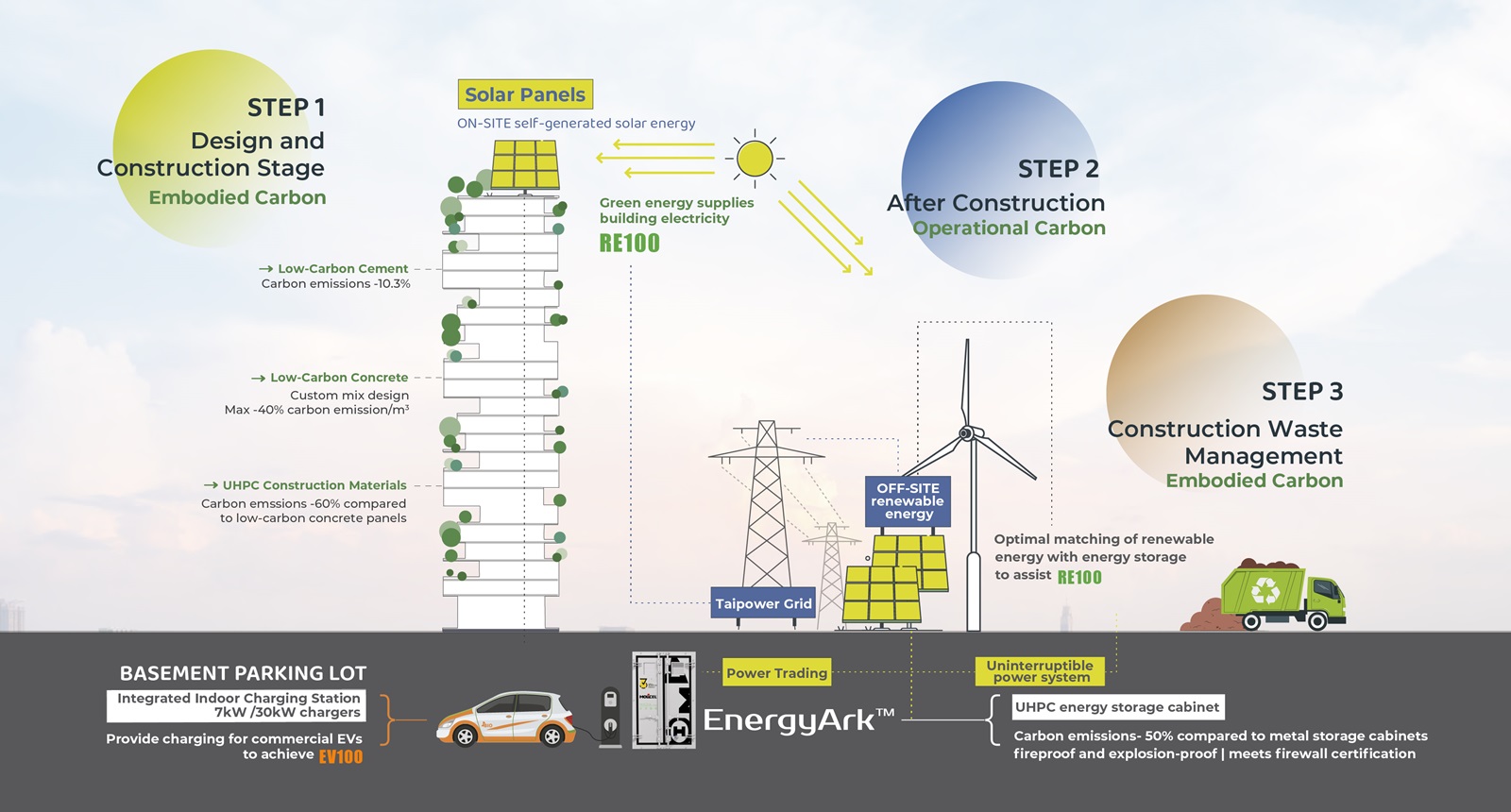

The UN estimates that by 2050, 68% of the world's population will be urban, with urban construction and public works accounting for 43% of global emissions. Embodied carbon, from construction materials, transport, construction, renovation, and waste, makes up about 35% of these emissions, while operational carbon from energy use accounts for 65%.

TCC is transitioning to low-carbon materials, resource recycling, and new energy, developing low-carbon products and services to meet demands for low-carbon materials, waste management, and green energy use. The “Total Solution: Low-Carbon New Energy Building Solution” addresses climate mitigation and urban resilience by assessing optimal low-carbon construction materials and energy use. It covers design, construction, operation, and urban renewal, offering a complete life cycle assessment and services for buildings.

Design and Construction Stage - Embodied Carbon

Estimated 30% average carbon reduction in building design (Based on Ministry of the Interior data)

- TCC's “Low-Carbon Building and Engineering Carbon Emission Calculation System” helps clients calculate carbon reduction using TCC's low-carbon materials.

- TCC offers low-carbon cement, concrete, and UHPC materials with complete carbon footprint reports, aiding in low-carbon building certification.

- TCC assists clients in planning and installing renewable energy and storage in new buildings or adding rooftop PV and storage in existing buildings to increase green electricity use.

- TCC helps install charging piles integrated with solar, charging, and storage to optimize energy use.

Building Use Stage - Operational Carbon

- Smart energy-saving services with renewable energy, storage, and charging equipment, integrated with EMS.

- Green power wheeling services.

- Aggregated energy trading platform management, including frequency regulation, spinning reserve, supplemental reserve, and backfeeding service planning.

- Uninterruptible power supply system planning to reduce costs and stabilize power grids.

C&D Waste Stage - Embodied Carbon

- Treatment of construction and demolition (C&D) waste from urban renewal or demolition.

- Use C&D waste as renewable resources, replacing raw materials in cement or as concrete aggregates.

Fubon Construction Property Insurance Headquarters Building

Kuma Tower

Yangde Museum of Art

| District | Project | Usage of Low-Carbon Concrete | Amount of Carbon Reduction |

|---|---|---|---|

| North District |

Fubon Construction

Property Insurance Headquarters Building

|

16,407 m3 | 37% |

| Taoyuan District | Dayi Technology Shanbi Factory | 13,000 m3 | 42% |

| Taichung District | Lufu Construction T6 Project | 61,423 m3 | 43% |

| Taichung District | Changan Daxu | 25,568 m3 | 42% |

| South District | Yangde Museum of Art | 11,891 m3 | 29% |

Supply Chain Management

-

Policy

TCC aims to maintain supply chain consistency on product quality, cost, delivery time, service quality, environmental safety and sanitation, and manufacturing. To achieve this, TCC established Supplier Management Policy Statement and Supplier Code of Conduct to jointly protect the environment, human rights, and sustainable resources for businesses with the suppliers. A joint effort to promote corporate social responsibility and a sustainable supply chain.

-

Sustainable Supply Chain Management Approaches

Risk and Impact Assessment- Identify ESG risks of suppliers

- New suppliers must sign the “Supplier Code of Conduct”

- Annually identify ESG risks

- 12 suppliers with potential/actual significant negative impacts

Sustainability Performance Evaluation- Supplier Sustainability Self-Evaluation Questionnaire

- The surveyed risk facets include: geopolitical, industry-specific, and commodity-specific risks

- In 2023, 301 suppliers subject to written review/on-site inspection

*In 2023, 3rd party on-site assessments were not conducted as all review subjects exceeded the criteria requiring such audits

Correction and Improvement- 91.86% suppliers with improvement plans introduced

- 100% Suppliers with improvement plans accepted

- 8.3% suppliers with cooperation terminated

Training, Empowerment, and Cooperation Capacity-building Program- Supplier GHG Inventory Counseling: In 2024, workshops in Taiwan and Mainland China will help suppliers implement GHG inventory systems. External consultants will instruct on identifying emission sources, collecting activity data, calculating GHGs, and interpreting results. Participants will complete on-site exercises and submit their GHG data for consultant review and ISO 14064-1 verification

- GHG / Sustainability Governance Workshop

- 95.7% valid carbon data from Significant Tier-1 Suppliers

- The 2023 Capacity Building Program included 290 enterprises

Supervision, Assessment, and Mutual Learning- 150+ suppliers attended Supplier Convention

-

Progress and Target of Supplier Assessment Program

2023 Progress 2023 Targets Number of suppliers assessed (written review and on-site inspection) 301 208 Results of Supplier Assessment Number of suppliers assessed with substantial actual/ potential negative impacts 12 - % of suppliers with agreed corrective action/improvement plan 100% - Number of suppliers that were terminated 1 - Progress and Target of Corrective Action Plan Number of suppliers assessed with substantial actual/potential negative impacts supported in Corrective Action Plan implementation 11 11 Number of suppliers supported in Corrective Action Plan implementation 11 - Progress and Target of Capacity Building Program Number of suppliers in Capacity Building Program 290 183 Note: The 2023 Capacity Building Program included 290 enterprises, exceeding the target of 183.

-

AI Procurement Portal

TCC launched the “Procurement Portal” with AI technology, boosting transparency and efficiency in procurement.

◤ Blockage rate of high risk suppliers ◤ Blockage rate for screening and blocking associated suppliers 100%

Supply Chain Management

Supply Chain Management