TCC's ESG Highlight: First Disclosure of sustainability/ climate-related financial information

- Home

- Sustainable E-newsletter

- TCC's ESG Highlight: First Disclosure of sustainability/ climate-related financial information

Governance 2024 Vol.02

TCC's ESG Highlight: First Disclosure of sustainability/ climate-related financial information

- #Sustainability-related Financial Disclosure

-

Share

In June 2023, the International Sustainability Standards Board (ISSB) announced the IFRS S1/S2 standards, making the financialization of sustainability information a global trend. In August of the same year, the Financial Supervisory Commission immediately announced that enterprises with a capital of NT$10 billion will need to disclose related information according to S1/S2 by 2026, aiming to enhance the international climate financial information transparency of Taiwanese enterprises and strengthen the prevention of greenwashing, contributing to Taiwan's effort towards a net-zero transformation by 2050.

Chairman Nelson Chang of TCC Group Holdings tasked the Office of Responsibility and Sustainability and the Finance Department to form a cross-departmental team, launching a six-month trial project on S1/ S2. From researching standards and disclosure topics to how to integrate and link accounting items, in the absence of any precedent to follow and without any disclosure examples from the government and the IFRS Foundation, TCC completed its first Sustainability and Climate-related Financial Information Disclosure Report in April 2024. This also provides a new framework for reviewing TCC's internal operational model and investment strategy, promoting financial performance and long-term value creation.

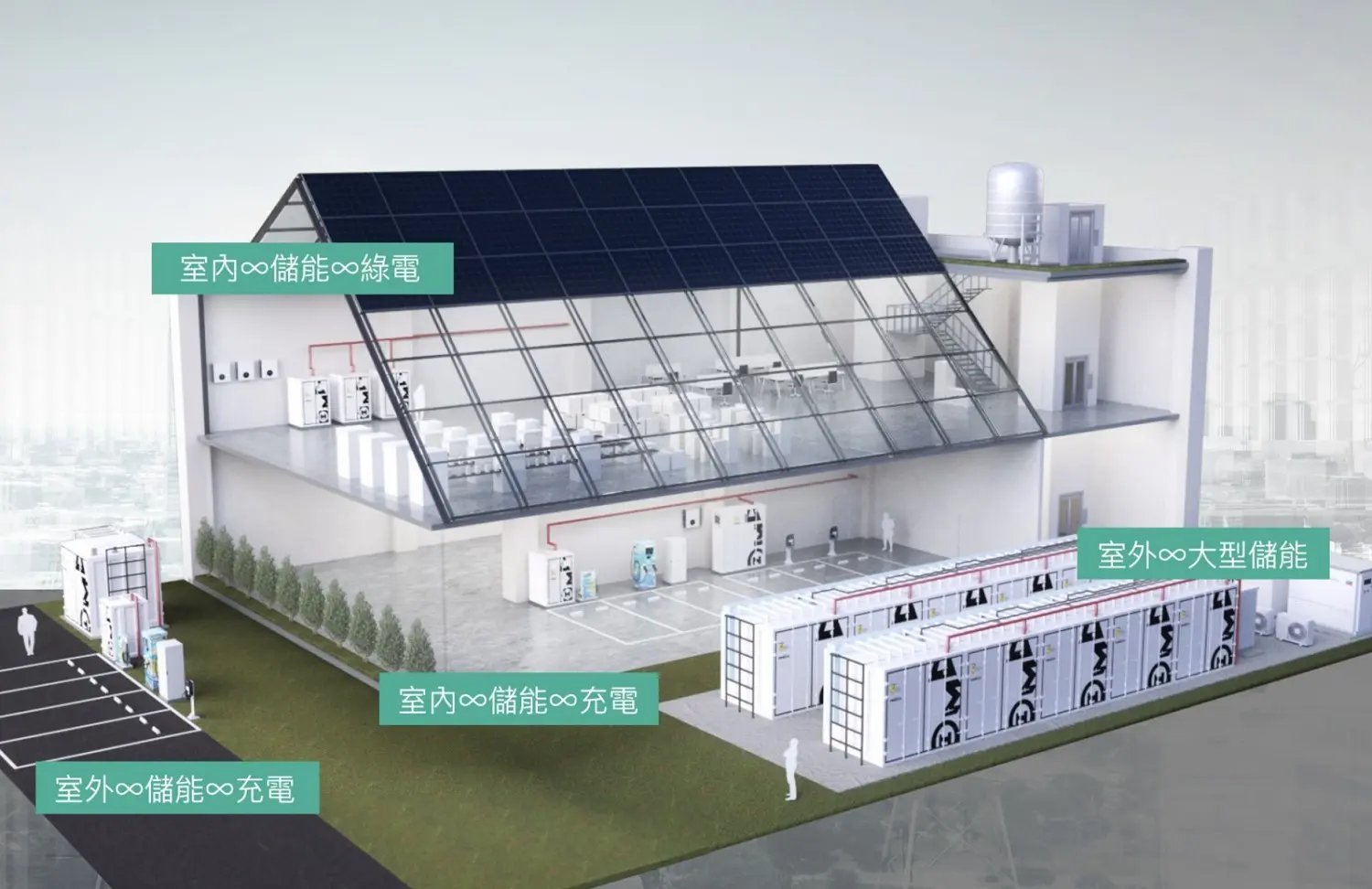

From the perspective of the primary users of general-purpose financial reports, including current and potential investors, lending banks, and other creditors, the project team based on the results of the 2023 double materiality analysis and strategic development focus, identified three material sustainability topics: "Climate Action and Net Zero Emissions," "Green Energy and Storage," and "Sustainable Products and Services." These topics identify reasonably expected sustainability and climate-related risks and opportunities that will impact TCC's outlook, and are a long-term commitment to sustainable development from TCC. Meanwhile proving that efficient operations through the disclosure of transparent financial figures under these three themes.

Let's quickly review the highlights of TCC's 2023 sustainability financial performance

THE SUMMARY OF TCC'S 2023 SUSTAINABILITY FINANCIAL PERFORMANCE | ||

DIVERSITY | Carbon reduction and green investment capital expenditure accounts for 68% of the total capital expenditure: TCC Group Holdings, spanning across Europe, Asia, and Africa, has invested in low-carbon construction materials, fully laying out the new energy industry chain, thereby diversifying its revenue streams. In the fiscal year 2023, the capital expenditure allocated to carbon reduction and green initiatives amounted to NT$16.875 billion, accounting for 68% of the total capital expenditure of NT$24,726 billion. |

|

RESILIENCE | 100% funded with operations generated cashflows: In 2023, TCC's total capital expenditure accounted for less than 80% of the net cash inflow from operating activities. In the fiscal year 2023, the net cash inflow from operating activities amounted to NT$33.75 billion, which is sufficient to fully cover the investment for low-carbon and new energy transition in the same year, while maintaining a robust balance sheet and cash flow statement.

| |

GROWTH | Profit attributable to the parent company grew by 48%: Continuing to invest and maintain positive profitability, the net profit for the year 2023 reached NT$10,005 billion, of which the net profit attributable to the parent company reached NT$7.998 billion, representing a net profit growth of over 140% compared to the year 2022, and net profit attributable to the parent company increased by approximately 48%. |

|

2023 FINANCIAL IMPACT

Unit: in Thousands NTD | Climate Actions and Net-Zero Emissions | Green Energy and Energy Storage | Sustainable Products and Services | Total |

Revenues | 748,807 | 5,817,397 | 39,279,069 | 45,845,273 |

Revenues (Onyx Ta-Ho Environmental Services Co., Ltd. Included) | 3,788,519 | 5,817,397 | 39,279,069 | 48,884,985 |

Cash Inflow from EU Subsidy | - | 371,713 | - | 371,713 |

Capital Expenditures | 5,218,254 | 11,539,175 | 117,523 | 16,874,952 |

Net Cash Inflow from Operating Activities | 33,751,150 | 33,751,150 | ||

Sustainable and Green Financing Cash Inflow | 30,829,871 | 30,829,871 | ||

You may also like

TCC GROUP HOLDINGS

SUSTAINABLE E-NEWSLETTER.