Outlook 2026: TCC Solidifies Global Resilience via Low-Carbon Tech and Accountable Governance

- Home

- Sustainable E-newsletter

- Outlook 2026: TCC Solidifies Global Resilience via Low-Carbon Tech and Accountable Governance

Governance 2025 Vol.04

Outlook 2026: TCC Solidifies Global Resilience via Low-Carbon Tech and Accountable Governance

- #Sustainable Governance

-

-

-

Facing 2025's volatility, TCC demonstrated the strength of its eight-year transformation and high accountability for managerial gaps. CIMPOR Global CEO Suat Çalbıyık identified the Europe-Africa unit as the Group's most robust profit engine, with a 31.7% EBITDA margin outperforming global peers.

To counter the 2026 EU CBAM, capacity for "deOHclay" will hit 1.5 million tons by late 2025. Paired with "IndustrAI"—which boosted mining productivity by 32%—TCC has successfully converted low-carbon R&D into a core competitive advantage for 2026.

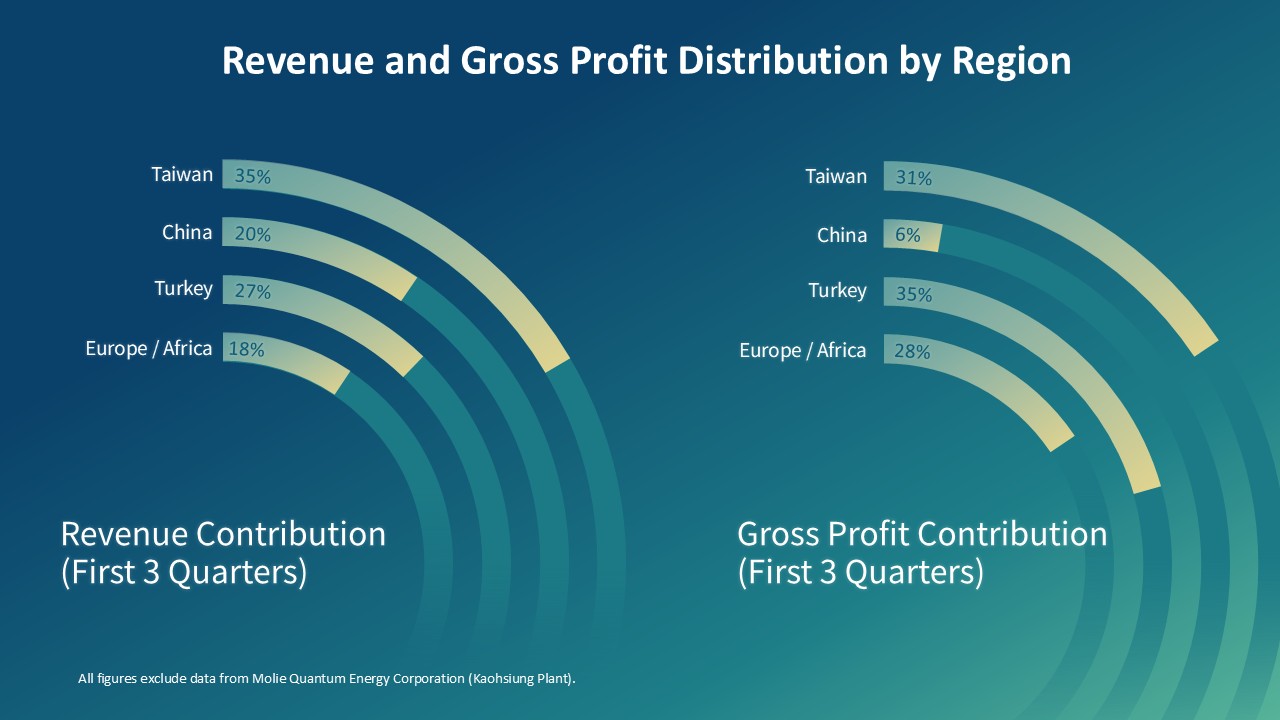

Behind steady profits lies systematized resilience. President of TCC Group Holdings, Roman Cheng, showcased a "Four-pillar" revenue structure spanning Taiwan, Turkey, Europe/Africa, and China, confirming that TCC has broken single-market reliance. With no region exceeding 35% of revenue, regional risks are effectively mitigated.

Addressing governance gaps, Cheng announced the adoption of RBA standards and ISO 31000 certification to institutionalize accountability. He further clarified that "88% of asset impairment is non-cash, having no impact on cash flow." With Q3 gross margins rebounding to 23%, the Group's fundamentals have stabilized.

Chairman Nelson Chang defined TCC's future under the theme Raison d'être. Acknowledging the past year's operational turbulence, he pledged, "Facing this year's unexpected challenges, TCC strives to be a deeply self-reflective enterprise." He reiterated that "protecting the planet is a responsibility; rewarding investors is a duty"—two goals that must coexist.

Looking to 2026, production sites will transform into "civilization-level systems" equipped with AI self-learning capabilities. Chang emphasized that this project goes beyond environmental responsibility; it aims to optimize management and efficiency to actively "reclaim time and value" for stakeholders.

Meanwhile, Atlante CEO Stefano Terranova announced a pivotal shift in 2026: transitioning from infrastructure buildup to an energy trading model. By leveraging Virtual Power Plants (VPPs) built on patented "EnergyArk" storage, Atlante is aggressively positioning itself to capture the €10 billion European energy trading opportunity by 2030.

Reflecting on 2025, TCC navigated volatility by accelerating governance upgrades. We transformed challenges into institutionalized management strengths—optimizing regional structures and adopting global standards to fortify the foundation for long-term value.

Outlook 2026, as low-carbon capacities come online and energy trading launches, we enter a "harvest period" for global expansion. Evolving into the resilient "civilization-level system" envisioned by Chairman Chang, we remain committed to honest, accountable governance, fulfilling our promises to stakeholders as we welcome the inaugural year of global value realization.

TCC GROUP HOLDINGS

SUSTAINABLE E-NEWSLETTER.

![[Insights] Prof. Hsu Analyzes the Impact of the Carbon Reduction Parent-Child Bankbook](https://www.tccgroupholdings.com/cache/1mg1ecKJmogVnVemxvm37GeQ5DOKob3HmLIwG7LdFL5qRdbhl8jOcnkCFJNRrTfbkVo2O3c72TZULcvQ9JwIKy1StZ4RCwri71mdRPITqgtjI91ox27E.webp)

![Data Transparency & Seamless Search: [TCC AI] Accelerates Your Insight into TCC's Global Operations](https://www.tccgroupholdings.com/cache/8MsCemoFENYJpr0bIteZ5jTXN7IbOFNiR6x1gkARXOxzmRilw0SQGUe3y1sYGyg5PmdKON8AoiGyVhYzbEkKuGsxMG99Avfkccy4rpjGS7qj8KziyE636sslc.webp)