TCC's Cimpor Outpaces Competitors with over 30% EBITDA; Aiming for €3.5 Billion Revenue by 2030 with Focus on Post-War Reconstruction

TCC's Cimpor Outpaces Competitors with over 30% EBITDA; Aiming for €3.5 Billion Revenue by 2030 with Focus on Post-War Reconstruction

2025.11.27

-

Copied

TCC Chairman Nelson Chang’s strategic layout in the European and African low-carbon cement markets is yielding significant results. At the investor conference today (27th), Suat Çalbıyık, CEO of TCC subsidiary Cimpor Global, unveiled the company’s 2030 strategic goals, targeting €3.5 billion (approx. NT$120 billion) in revenue and €1 billion in EBITDA.

Suat presented data demonstrating that the Europe-Africa business has become the Group's most profitable segment. The 2024 EBITDA margin reached 31.7%, significantly outperforming global giants like Holcim (24.5%) and Heidelberg (21.1%). Since TCC’s investment began in 2016, net profit has surged fivefold, and the company has successfully shifted its financial structure from debt to a net cash position.

In his opening remarks, Suat reflected with sentiment that working with Chairman Nelson Chang since 2018 has been like taking a "masterclass in clarity and long-term strategy." He emphasized, "Chairman Chang always foresees risks and opportunities ahead of the market. That vision has been the guiding force behind our global platform’s development." Suat noted that the union of TCC, Cimpor, and OYAK represents the creation of a "super green powerhouse." This partnership not only injects high-profit and high-tech DNA into the group but also lays a rock-solid foundation for TCC.

On the risk management front, Suat highlighted the company's financial efficiency: "In the Portuguese and African markets, our receivables turnover rate reaches 12 times annually, meaning we collect payments in approximately 30 days on average." Furthermore, as of the end of the quarter, the net secured ratio stood at 92.3%, indicating that the vast majority of accounts receivable are collateralized. This effectively eliminates collection risk and demonstrates the TCC team's precise execution in operational optimization.

Addressing investor inquiries regarding future market momentum, Suat proposed a macro theory of a "Cement Consumption Super Cycle." He asserted, "Africa and Turkey are at the starting point of a growth trajectory that will span the next 20 years." regarding geopolitics, he emphasized, "From Romania serving as a gateway to Ukraine, to the post-earthquake reconstruction plan of 500,000 homes annually in Turkey, TCC has secured core strategic positions." Turning to the seemingly mature European market, Suat highlighted Portugal's launch of a €100 billion infrastructure plan. "The funding is already in place," he stressed, "and with our market share reaching 55% this year, we are the largest player in the Iberian market."

Responding to Suat's unreserved strategic analysis, Chairman Nelson Chang humorously remarked, "I didn't expect we'd be giving everyone a history and geography lesson today." Chang acknowledged that details revealed by Suat, such as the scarcity of limestone in West Africa, were originally confidential internal data. However, sharing them demonstrated that TCC’s "strategic deployment is already fully in place." He emphasized that the lack of limestone actually presents a unique opportunity for TCC, capitalizing on its proprietary calcined clay technology. Addressing market concerns about inflation in Turkey, Chang asserted there is "zero impact." He explained that TCC’s exceptional operational efficiency has offset cost pressures, making Turkey the region with the best gross margin performance in the entire Group.

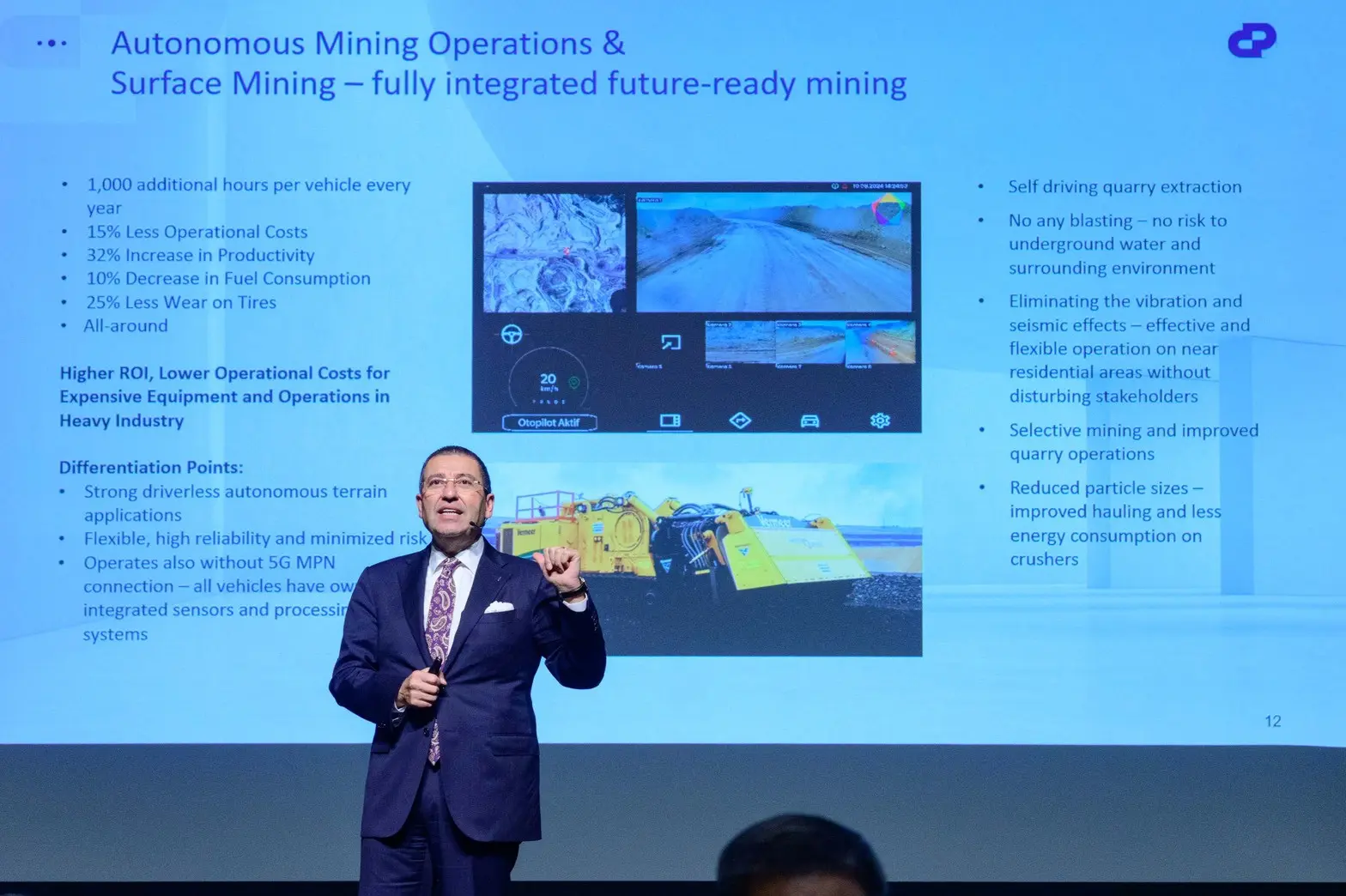

Cimpor Global is also at the forefront of decarbonization and technology. To address European carbon taxes, TCC has prepared a "secret weapon": deOHclay (calcined clay), with production capacity expected to reach 1.5 million tons by the end of 2025. Suat also shared a moving example: Following the massive earthquake in Turkey two years ago, the company implemented "Urban Mining" technology to transform disaster debris into construction materials for rebuilding, demonstrating the humanitarian value of technology. Furthermore, by integrating the "IndustrAI" industrial digitalization system and KUARTIS automated mining technology, mining productivity has increased by 32%, achieving a dual transformation toward high-tech and low-carbon operations.

To access the full presentation, please click here.

More Related Information

-

2025.11.27Atlante Unveils 2030 Strategy: Targeting €10 Billion in European Energy Trading Backed by EU Grant to Lead Electric Truck Charging Revolution

2025.11.27Atlante Unveils 2030 Strategy: Targeting €10 Billion in European Energy Trading Backed by EU Grant to Lead Electric Truck Charging Revolution -

2025.09.27TCC’s Hoping Plant Sets a Precedent: Turning Waste into Energy with Cement Kilns, Driving Environmental Benefits and Local Employment

2025.09.27TCC’s Hoping Plant Sets a Precedent: Turning Waste into Energy with Cement Kilns, Driving Environmental Benefits and Local Employment -

2025.09.27Rebirth After the Quake: TCC DAKA Unveils the “Nautilus Bibliotheca” as Its New Landmark

2025.09.27Rebirth After the Quake: TCC DAKA Unveils the “Nautilus Bibliotheca” as Its New Landmark