Is Taiwan facing a carbon reduction loophole? Father of Taiwan's carbon trading is here to answer

- Home

- Sustainable E-newsletter

- Is Taiwan facing a carbon reduction loophole? Father of Taiwan's carbon trading is here to answer

Environmental 2024 Vol.01

Is Taiwan facing a carbon reduction loophole? Father of Taiwan's carbon trading is here to answer

- #Carbon Leakage

-

Share

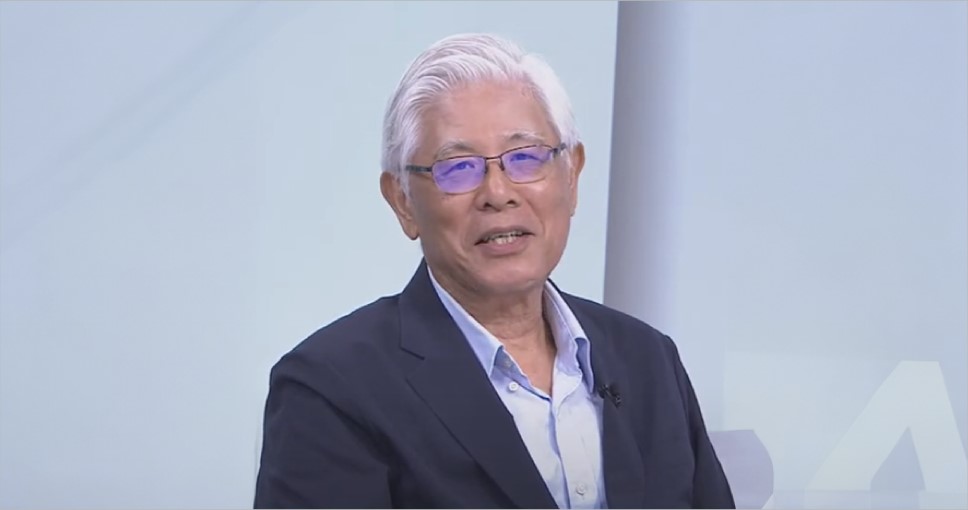

As global net-zero carbon emissions become imperative, every country and international corporation is setting net-zero targets and actively implementing carbon emission management. Taiwan plans to levy a carbon fee in 2025, and the normative standard will base on emissions in 2024. However, while collecting the carbon fee, without complementary measures to avoid carbon leakage, it may cause Taiwan's industrial value chain to increase carbon emissions instead of reducing them. What exactly is carbon leakage? The editorial team of Office of Responsibility and Sustainability from TCC interviewed the "father of Taiwan's carbon trading" Dr. Lee, Chien Ming, Professor at the Institute of Natural Resources Management, National Taipei University, here is the answer.

Taiwan's implementation of a carbon fee must be accompanied by complementary measures to avoid carbon leakage

Professor Lee, Chien Ming indicates that Taiwan's carbon fee system, which started this year, only collects fees from domestic industries without appropriate preventive mechanism, which may result in carbon leakage. For example, when Taiwan implements a carbon fee, resulting in higher production costs for the steel industry, imported steel that is not subject to carbon fees may replace domestic products. Professor Lee, Chien Ming pointed out that the steel and cement industries are high-risk industries for carbon leakage, which is why the EU provides free allocation for these two industries when implementing carbon pricing. Energy-intensive industries such as paper, textiles, petrochemicals, and semiconductors also need to carefully consider the impact of carbon leakage on their industries.

Professor Lee, Chien Ming suggested that Taiwan, while promoting carbon fees, could also refer to the EU's promotion of the Emissions Trading Scheme (ETS) to provide free quotas and not levy carbon fees within a limited time and proportion; or it could refer to the EU's Carbon Border Adjustment Mechanism (CBAM) approach. These two measures are crucial, and a comprehensive approach should be established when implementing carbon fee collection to prevent carbon leakage.

The initial stages of carbon pricing in the EU saw an increase in the carbon footprint of imported products, which is worth considering for Taiwan

Professor Lee, further explained the EU's carbon pricing policy, which is worthy of Taiwan's reference. The EU began implementing carbon trading mechanisms as early as 2005, with the period from 2005 to 2012 considered a learning process, during which companies mostly received free allocation. It was only from 2012 to 2020, entering the third phase, that most allowances had to be purchased, with the EU identifying industries at high risk of carbon leakage based on the cost of carbon reduction, electricity cost pass-through, and product added value, and providing them with free quotas.

However, in 2015, GHG emissions embodied in the EU trade found that the carbon emissions from imported products were three times that of exported carbon emissions. Professor Lee, explained, "Other countries' regulations are not as strict as the EU's, which makes total carbon footprint of imported products higher than that of exported products during the same period. EU found that the actions could not affect other countries' carbon reduction efforts, and it provided the EU with a basis to promote the Carbon Border Adjustment Mechanism (CBAM)". Therefore, in 2021, the EU began the fourth phase and started promoting CBAM.

The current international trend emphasizes carbon reduction in the value chains of enterprises. If Taiwan only implements carbon pricing domestically without CBAM as a complementary mechanism, it may lead to the importation of high-carbon-emission products from abroad, resulting in an increase rather than a decrease in carbon emissions in Taiwan's industrial value chain, which would damage Taiwan's national and industrial carbon competitiveness.

Promoting Taiwan's CBAM carbon border mechanism is not a trade barrier

The Climate Change Response Act stipulates in Article 31 that to avoid carbon leakage, imported products should report their carbon emissions and obtain emission reduction credits or pay monetary substitution. This is the legal basis for Taiwan's establishment of CBAM to levy fees on imported high-carbon-emission goods, yet Taiwan's Ministry of the Environment has not yet formulated subsidiary regulations.

Regarding concerns that the establishment of a Taiwanese version of CBAM would violate international free trade agreements, Professor Lee, pointed out that the EU also carefully considered this issue before promoting CBAM. However, the General Agreement on Tariffs and Trade (GATT) stipulates that measures are necessary to protect human, animal , or plant life or health. It does not violate international trade norms. CBAM aims to restrict greenhouse gas emissions and prevent global warming, and the money collected by the EU CBAM is also returned internationally to help other countries cope with climate change.

Professor Lee, stated that the EU has made it clear that the spirit of CBAM is to extend the EU Emissions Trading System (EU ETS) to the border. For products under EU ETS control, importers of these products must also be regulated. In addition to calculating emissions, they must refer to the EU ETS weekly average price and buy CBAM certificates, bearing the same carbon costs. If there are free allocation for the product within the EU, the imported product can also be offset.

The last but not the least, Professor Lee, Chien Ming concluded that establishing a Taiwanese CBAM would not be a trade barrier but would rather allow domestic and imported products to compete fairly under the same conditions.

You may also like

TCC GROUP HOLDINGS

SUSTAINABLE E-NEWSLETTER.